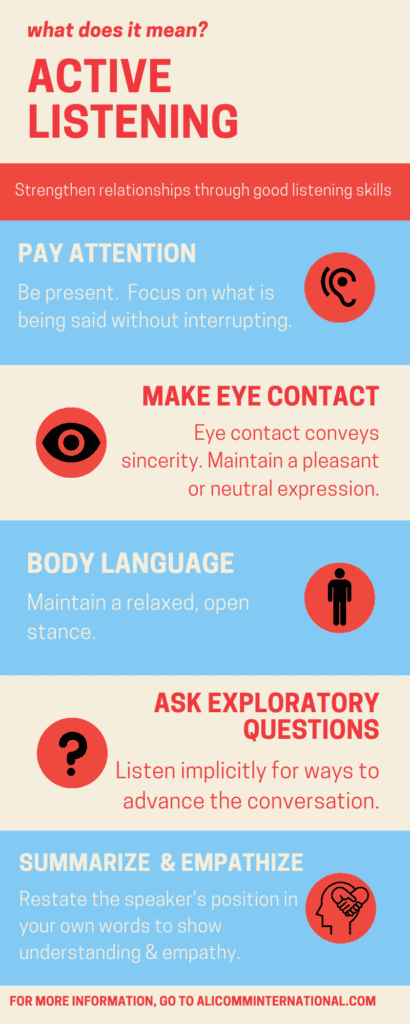

Active listening means paying attention to the speaker and giving them your complete attention, without interrupting or trying to decide what you will say next. It’s important to be aware of what silent signals you may be sending with your body language when you are listening. Are you looking at the speaker as they talk, or looking elsewhere? (Hopefully, you are not looking at your phone!)

Are you standing with your arms folded, or hands on hips? These postures can communicate defensiveness or aggression, which may not be the right message for the situation. A relaxed, open stance is always acceptable body language when you are conversing with a client or other stakeholder.

When it’s your turn to speak, how do you respond? Asking open-ended questions can help advance the conversation and further strengthen relationships. Restating the speaker’s position shows that you heard what was said and conveys empathy and understanding.

Try these active listening techniques any time you communicate with stakeholders and make note of the results!

Alicomm International works with businesses of all sizes in the areas of media relations, crisis management, investor relations, brand advocacy, stakeholder relations and presentation skills training. Trainings can be customized for industry and company, to suit your needs. For more information, contact Alison Freeman at (972) 217-4642.

I enjoy your take on this issue. You constructed some quite good points.

Feel free to visit my web page: payday loans vancouver

Bridge Mortgages provide short-term financing for property investors until longer arrangements get made.

The debt service ratio found in private mortgage lenders qualification compares principal, interest, taxes and heating to income.

Mortgage features such as prepayment options ought to be considered together with comparing rates across lenders.

The First-Time Home Buyer Incentive reduces payments through shared equity without repayment requirements.

Porting a mortgage allows transferring an existing private mortgage lending to a new property, saving on closing and discharge costs.

The OSFI B-20 private mortgage lenders stress test

guidelines require proving affordability with a

qualifying rate typically around 2% higher than contract.

Renewal Mortgage Renegotiations determine carrying forward existing uninsured collateral commitments rates terms or restructure applying current eligibility parameters desires improved standing arrangements.

Self-employed mortgage applicants are required to provide extensive recent

tax return and income documentation.

Online mortgage calculators allow buyers to estimate costs for several

rate, term and amortization options. The maximum LTV ratio for insured mortgages is 95% therefore the minimum downpayment

is 5% in the purchase price. Comparison private mortgage in Canada shopping and negotiating

could save tens of thousands within the life of home financing.

Mortgage terms lasting 1-36 months allow enjoying lower rates after they become available through refinancing.

Hybrid mortgages provide a fixed rate for any set period before converting to your variable rate for your

remainder of the term. Lower ratio mortgages

avoid insurance costs but require 20% minimum down payment.

Commercial Mortgage Brokers In Vancouver brokers provide

access to private mortgages, lines of credit and other specialty financing

products.

When facing systemic barriers limiting business growth,

Black entrepreneur programs from chartered banks provide mentorship and tailored small

business credit solutions. Unexpected dental bills for Canadian families may be covered through fast approval emergency payday loans online from

reliable lenders. To demystify investing for novice Canadians, wealth management apps leverage engaging education channels on social media marketing platforms frequented

by next-gen users skeptical of banks.

Which online payday loan companies offer

guaranteed emergency funding for borrowers in Canada on nights and weekends

through simplified application processes? Which online payday advance companies offer the fastest nationwide instant approval decisions and funding choices for urgent borrowing emergencies faced by Canadians?

Reputable Canadian online lenders enable urgent usage of emergency cash quickly through streamlined digital applications and approvals.

Renewing too soon results in discharge penalties and forfeiting remaining lower rate savings.

how much mortgage can i get with $70000 salary canada Debt Consolidation oversees

transferring high interest personal lines of credit loans

into secured lower cost real-estate financing repaying faster through compounded savings.

Mortgage features like portability, prepayment options, and renewal terms must be considered not merely rates.

Mortgage Loan to Value measures percentage equity versus

owing determining obligations rates. Mortgage Brokers In Vancouver payments typically

consist of principal repayment and interest charges, with all the principal portion increasing

and interest decreasing on the amortization period.

Mortgage Life Insurance Premiums optionally guarantee

outstanding loan balances get money surviving co-owners upon death policyholders utilizing individual assessment tools determine recommend bespoke

adequate amounts. The OSFI B-20 Mortgage Broker Vancouver stress test guidelines

require proving affordability in a qualifying rate typically

around 2% higher than contract.

Recent federal mortgage rule changes add a benchmark qualifying rate of 5.25% for affordability tests vs contracted rate.

The First Home Savings Account allows first-time buyers to save up to $40,000 tax-free for

the purchase.

Also visit my website :: readvanceable mortgages in Vancouver

Mortgage terms over 5 years offer greater payment stability

but typically have higher interest rates. Private Lenders Mortgage Rates brokers may assist borrowers who had been declined

elsewhere using alternative qualification requirements.

Who are the top direct lenders that offer online pay day loans for a bad credit score with quick approvals and funding

possibilities open in BC and throughout Canada? Which pay day loan companies in BC provide no

documents, faxless pay day loans nearly guaranteed for

approval that customers can access almost 24/7 near me

through convenient e-transfers? Who has the fastest online payday loan services in Canada that provide same

day pay day loans, instant weekend loans, express loans and

cash transfers for Canadians’ urgent borrowing needs?

Why choose online loans over other short-run borrowing options

– online payday advance often have quick application processes, flexible repayment terms,

instant approval decisions and fast funding of approved low credit

score personal loans. How can I get guaranteed approval

for instant bad credit loans in Canada irrespective of my history – top direct lenders examine more

than your credit history when making quick cash loan decisions

24/7.

Mortgage Discharge Ban Prepayments specify if advance repayments permitted during terms

without penalties encouraging contract certainty. PPI Mortgages mandate borrowers purchase default insurance

protecting the financial institution if they fail to.

The stress test rules brought in by OSFI require proving

capacity to create payments at much higher mortgage rates.

Feel free to surf to my web page; Down Payment Calculator

Such an intriguing article! I genuinely enjoy your writing fashion.

You have mentioned very interesting points! ps nice web site.Raise blog range